There is no free lunch in grain marketing.

I was recently looking back at the VeraSun bankruptcy and I think it is a worthwhile exercise to revisit some of the circumstances that surrounded it.

Bankruptcies like these are very complicated and the exact cause is a confluence of many unique factors.

While I don’t have exact knowledge of the company’s hedge positions during the time leading up to their bankruptcy, court documents give us some telling information. On Sept. 16, 2008 VeraSun released the following statement:

“In July 2008, after corn prices had risen from approximately $6 per bushel at the end of May 2008 to almost $8 per bushel due to extraordinary weather conditions in the Midwest and broader market commodity trends, we effectively priced our corresponding physical purchases of corn at the then-current market price, which proved to be significantly higher than today’s market prices for corn. In addition, based on market forecasts that prices would continue to rise, we entered into a number of “accumulator” contracts relative to corn requirements for the third and fourth quarters that, in each case, allowed us to purchase a specified volume of corn at prices below then-prevailing market rates, but also required us to purchase that same volume of corn (in addition to the initial purchase) at one or more lower prices per bushel should market prices decline to or below those lower levels over the duration of the contract. Shortly thereafter, corn prices commenced a sharp decline from almost $8 per bushel to a low of under $5 per bushel in mid-August 2008. As a result, we were required under the accumulator contracts to purchase additional amounts of corn at prices that proved to be higher than prevailing market prices.”

Source: http://www.ethanolproducer.com/articles/6623/the-rise-and-fall-of-verasun-continued

This is speculation on my part, but here is what likely happened.

They had short corn hedges in place on their physical corn purchases. Due to either financial (lack of liquidity to fund margin calls) or emotional stress, they lifted their short corn positions essentially locking in their hedge loss and locking in a final price for their physical corn purchases at very high prices historically.

This is pure speculation on my part, but I’m guessing they didn’t contract/hedge their ethanol at the time they lifted their corn hedges (or enough of it). As a rule of thumb, a commodity business should be locking in revenue and the same time they are locking in costs. This becomes more difficult in a low margin environment but when you’re locking in $7+ corn purchases you need to be locking in a sizable amount of the revenue side of the transaction.

The likely fatal blow…..entering into accumulator contracts where the company could purchase corn for below the market. The contract made this possible because they likely sold multiple put options and used that premium to offset the market price of corn. The extra premium they received by selling the put options came back to haunt them as the market fell below the strike price of the puts. This meant that they had to “purchase additional amounts of corn at prices that proved to be higher than prevailing market prices.” They added a hedge loss to their prior hedge loss.

Hindsight is always 20/20 but farmers need to be cautious when hedging. Financial markets have a tendency to move much higher or much lower than most of us expect.

Oftentimes, what is too good to be true really is too good to be true.

Farmers are often pitched a variety of exotic farm risk management contracts. The phrase “there is no free lunch” is very relevant when discussing these contracts.

I’ve heard the following statements many times over the years.

“I got a call from ABC Grain Company and if I agree to commit 3 years of bushels to them they’ll build me a new grain bin.”

or

“I can receive a $.20/bushel premium for my corn today if I agree to sell them the same amount of corn next year for $4.50. That’s a great price! Why not?!”

I’m not going to dive too deep into the details, but these contracts most often involve short options. The farmer’s counter-party (grain buyer) is using your bushel commitment to sell options. They keep some of the premium they receive and they pass the rest on to you.

There is nothing inherently wrong with these contracts. You just need to thoroughly understand the risks before entering into one. In today’s low margin environment, you don’t need any extra risk in your operation!

A short crop combined with an accumulator/double-up contract can be a fatal blow. If you do have a contract with a double-up contingency, make sure you keep some open and insured bushels available to fill it.

Proceed with caution when entering into accumulator or premium offer contracts……

Let’s take a deeper dive into accumulator contracts.

There are many different variations of an Accumulator. For the purposes of today’s newsletter, we’re doing to discuss one that has the following features.

Contract Mechanics You will receive a base price plus a certain premium. Let’s assume today’s futures price for soybeans is $10.00 and there are 100 trading days left until expiration. You are quoted a $.40/bushel premium in this contract. More on why you get this premium and what you “give up” below.

You will lock in a $10.40 futures price on 1% of the bushel amount each day.

Sounds great, right? Remember….there’s no free lunch!

Knock-out Price In a contract like this, there would be a price at which the contract end if it’s breached. In this example, let’s assume the Knock-Out Price is $9.00.

If soybeans trade below $9.00 futures, the contract ends and you receive a contract for the bushels that have already been priced by the contract. If this occurs 21 days into the contract, you’d receive a contract for 21% of the original bushel size.

This is easy to understand…..but there’s typically another kicker. Let’s look at it below.

Double-Up Price In addition to the Knock-out Price, there is typically a price above the contracted price at which you will be obligated to deliver an additional amount equal to the contract size if settled above at expiration.

It sounds complicated above but it isn’t.

For purposes of this example, let’s assume we have a double-up price of $11.00.

If soybeans are trading above $11.00 at expiration of the contract (once again the contract specifics vary from contract-to-contract), you will be obligated to sell them an additional amount at the price equal to your current contract size.

Let’s assume, you contracted 10,000 bushels under this Accumulator. If the market is above $11.00 you’d be obligated to deliver another 10,000 bushels at $11.00.

You’d then have 10,000 sold at $10.40 ($10.00 plus $.40 premium) and 10,000 sold at $11.00.

Many producers often look at that and say, “Sounds good to me, I’d love to have another 10,000 bushels sold at $11.00!”.

Not so fast…..

The Knock-Out or Double-Up provisions aren’t “bad deals” themselves, it’s the combination of them that can get nasty.

Here’s how I’ve seen many of these contracts play out over the years.

- Joe Farmer raises 1,000 acres of soybeans with an APH of 50 bushels

- He enters into an Accumulator contract for 20,000 bushels

- The market rallies close to his Double-Up price so he mentally allocates 40,000 bushels to this contract

- Joe’s wife says, “Hey dear, soybeans have rallied nicely lately. Have you sold any?”

- Joe says, “Most of our production is already "spoken” for. We should end up with a good average price.“

- The key word there…..should

- Well….the weather scare ends or the USDA puts out a bearish report and the market falls out of bed

- Joe’s contract hits is Knock-Out price after 17% of his contracts has "expired”

- Joe ends up with 3,400 out of 50,000 bushels sold

- “Sorry Honey, it’s Fargo for vacation this winter, not Cancun”

All of these exotic grain contracts tend to sound like good deals on the day you look at them.

It’s due to one of our downfalls as humans.

Most of us (myself included to some extent) suffer from recency bias. We tend to focus on the current trading range when viewing grain marketing opportunities while discounting the probability of large moves outside of this range.

These large moves happen ALL THE TIME!

See the image below for how these contracts tend to make producers feel during periods of market volatility.

When pitched exotic grain marketing contracts/strategies, remember….there is no free lunch!

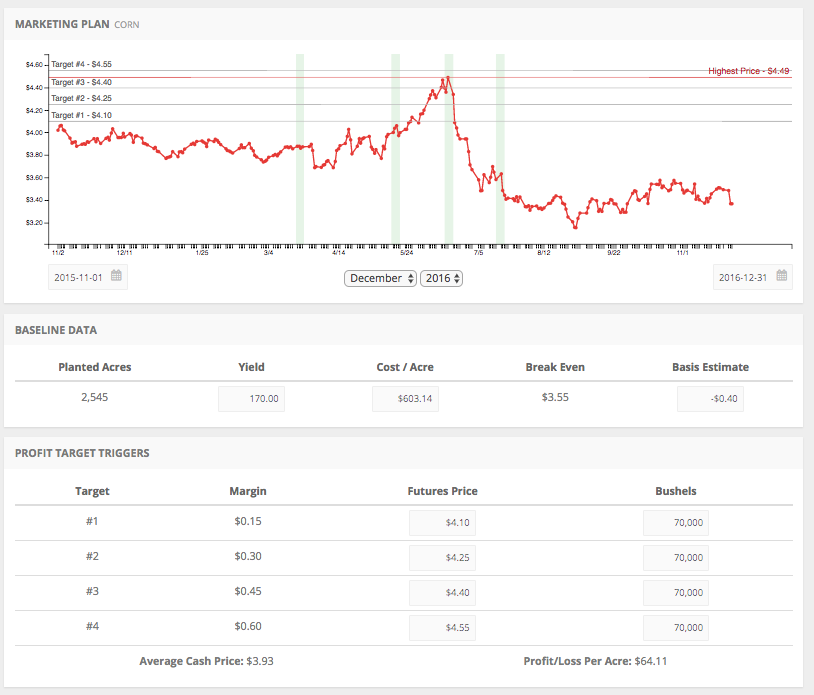

We favor a simple profit-based, seasonal trend-focused grain marketing plan. We include a grain marketing plan builder in our farm management software that uses your farm’s costs, yields, etc.

If you’d like to jump into a live account, click the button below for a free demo.

We’d love to help your operation track, analyze, and optimize profitability going forward!

Nick Horob

Passionate about farm finances, software, and assets that produce cash flow (oil wells/farmland/rentals). U of MN grad.

Related Posts

New Feature Friday - Grain Marketing Plan Builder

In this post, we discuss a valuable feature of our farm business software: a grain marketing plan builder. Grain marketing is emotional! This tool allows producers to minimize those emotions by implementing a sound grain marketing plan.

Read More »Grain Marketing can be an Emotional Roller Coaster

Grain marketing is hard! Volatile commodity markets lead to frustration, greed, and indecision. Today's farmer needs to work hard to find a risk management system that allows them to make less emotional, and more profitable, grain marketing decisions.

Read More »