Market volatility is back!

With that price volatility, comes the emotional roller coaster that accompanies any financial market. There’s no getting away from the emotional ties that come with grain marketing.

We have to recognize the predicting the future is impossible and you simply have to make the best decision for your operation given the variables in front of you today.

See below for an excellent representation showing how humans typically respond to financial market volatility.

There is one key difference between the image above and the real-world grain marketing roller coaster…..

There are often just as many producers who are angry at the “top” vs. those that are euphoric.

“Why the hell did I sell new crop soybeans at $9.50!!!”

Selling into rallies becomes frustrating for many producers as their early, pro-active sales become “too cheap” with the benefit of hindsight. We all need to realize that in 99.99% of instances, a grain marketing sale/hedge can always be judged in one of the two following ways.

- “I sold too little. That was a good price, why didn’t I sell more?”

- “I sold too much. I really wish I would’ve waited for this last $.25 rally before making the last sale!”

No sale/hedge is perfect. In an ideal world we’d wait for the top and sell it all. Well, we don’t live in an ideal world!

Even the most structured grain marketing plan can be hard to implement in real time. See below for an example marketing plan that inlcudes profit-based price targets and decision dates targeting the seasonally strong times of the marketing year.

(This marketing plan was built using the farm risk management software we’ve built. To learn more, sign up for a demo webinar on our home page.)

Note: All price targets of this hypothetical plan have been hit. We’re converting to an OHLC-type chart to better display intraday price moves.

(This marketing plan was built using the farm risk management software we’ve built. To learn more, sign up access to a free demo account below.)

In many cases, a producer with the above plan in place would fail to pull the trigger when the 3rd and or 4th targets are hit. The producer will be frustrated with the 1st and 2nd sale and will transition from “marketing plan” mode to “hit the high” mode.

We need to try our best to fight that mindset. We need to focus on making decisions that make financial sense for our farm. Easier said than done, I know.

Here’s a simple framework for how I like to approach farm risk management.

- Realize the price prediction is nearly impossible, specifically the timing of price moves. (eg. who predicted oil would drop from $100 to $30? How many predicted that oil was doomed after we already had fallen $50+? This happens over and over in financial markets.)

- Use the seasonal tendencies to your advantage. Premium prices tend to occur during periods of where the crop can put in peril. This most often occurs from April-July. Making panic sales below your cost of production during the winter is rarely the right thing to do. Put your self in a position where you don’t need to make sizable marketing moves during these seasonally weak times of the year.

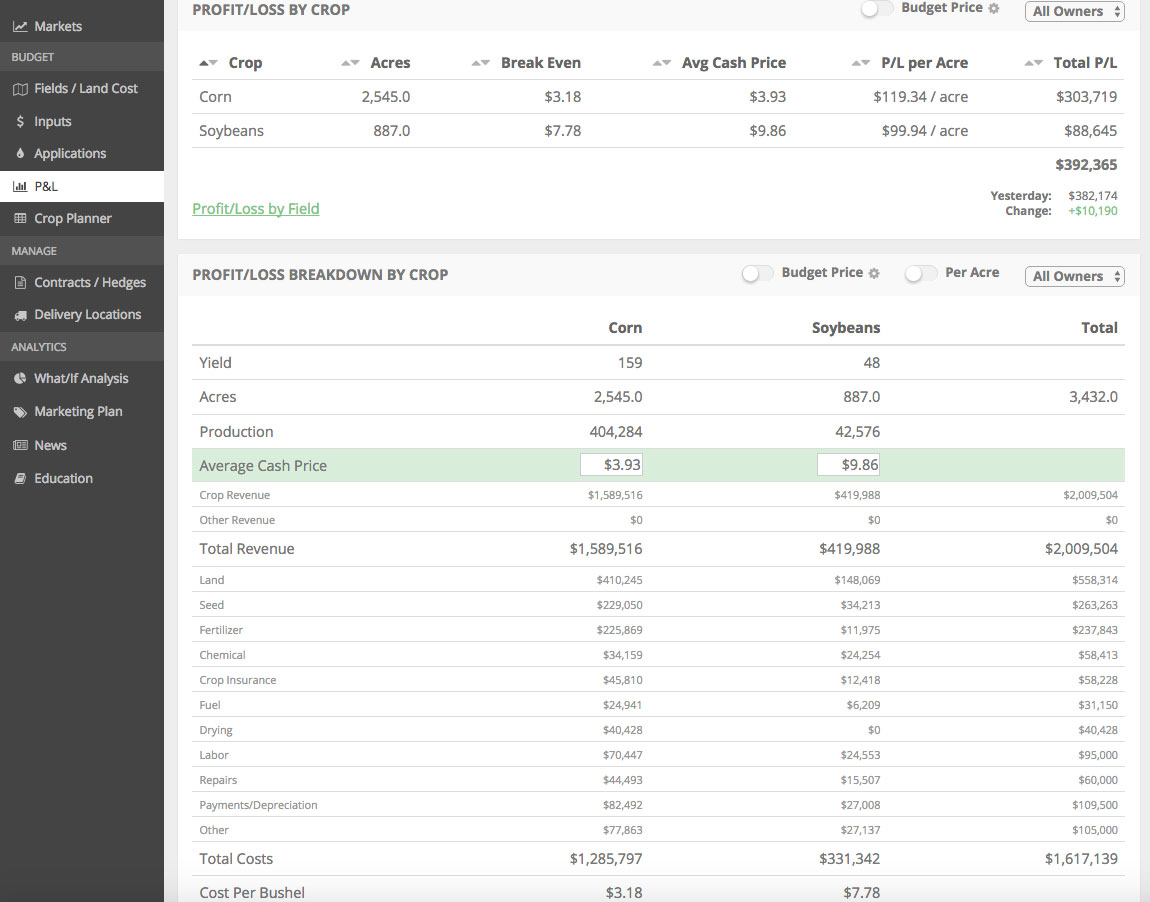

- Know your numbers. The market doesn’t care about your specific cost of production, obviously! But knowing your numbers will allow you to make confident risk management decisions in the face of always-changing commodity prices.

- Make a decision and don’t look back. Don’t let past decisions handcuff you from taking advantage of profitable marketing opportunities. What’s done is done!

All of this is easier said than done. Find a system that works for you and work hard to maintain discipline. Farming is a business and a big business for most of you. Treat it like a business not a speculative, volatile hedge fund.

If you’d like to learn more about our software as well as receive educational articles, sign up for our newsletter below.

Nick Horob

Passionate about farm finances, software, and assets that produce cash flow (oil wells/farmland/rentals). U of MN grad.

Related Posts

Don't Rely on Crop Insurance as Price Protection

In this blog post we revisit the actual price protection provided by multi-peril crop insurance. In most instances, don't rely on crop insurance as a marketing tool.

Read More »