Hosting a grain marketing meeting for Ag lenders at the elevator for three years (2016-2018) launched me on a mission to understand two crucial parts of a farm business. The meetings aimed to present our grain marketing approach and plans that we proposed to our customers with the lenders. The first year we had 30 lenders show up.

We asked one question when inviting ag lenders to the meeting the first year, “From your seat, what’s the biggest concern on farm?” We received a lot of interesting answers but one senior lender responded confidently, “that’s easy, WORKING CAPITAL.”

I replied, “What is working capital all about?” He went on to explain it very well from his point of view.

Since that conversation, I’ve been trying to connect working capital and grain marketing. In this grain originator role, I witness hundreds of grain marketing transactions with customers. As a result I’ve developed some rules-of-thumb of best practices over time.

I knew little about working capital at that time. Conversations with lenders and digging into accounting I’ve been able to connect the two in my mind but I’ve yet to persuade the farm that it’s important to connect working capital and grain marketing. Not many farms want to talk financials with the grain buyer, for many reasons, understandably. Maybe I should “stick to my knitting” and solely focus on grain buying but I really believe connecting these two parts of the business will be a positive impact on the farm.

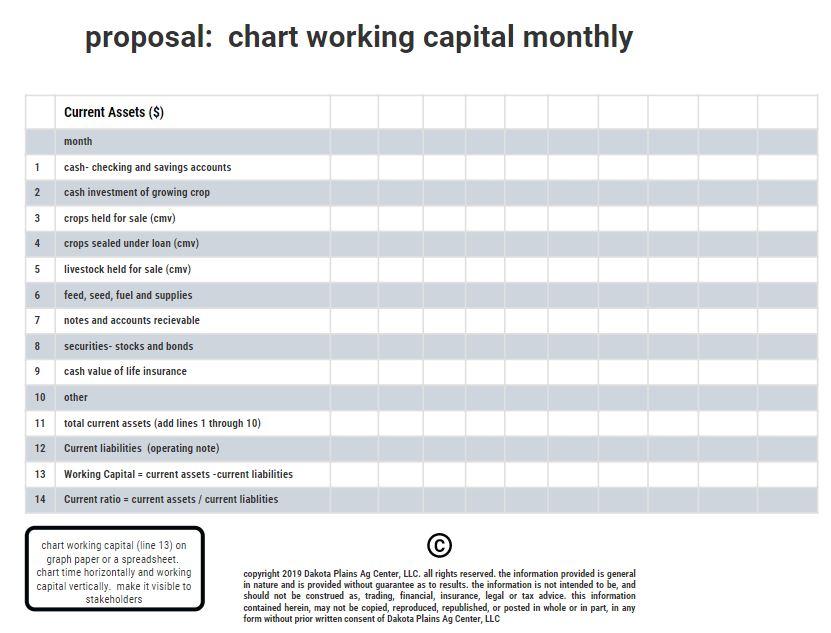

In this article, I propose the farm track working capital monthly and make it visible to stakeholders. A proposal is simply a suggestion. One can only propose if he doesn’t have skin-in-the-game on your farm. If you disagree with the proposal, carry on with your regular practice.

I forecast three positive outcomes of tracking working capital. The forecasts rely on a hunch. I can’t verify the hunch without proposing to a wider audience since I do not farm and lack volunteers to do the research. I’m curious to receive feedback from farms and Ag lenders who are already connecting working capital to grain marketing decisions in practice.

Tracking working capital on the farm will make the farm a star client with the lender and put the farm operator/manager in the driver’s seat. Working capital is lend-ability. Working capital is self-insurance and self-financing in crop peril and emergency.

Surplus working capital is the green light on farm expansion or debt reduction.

Working capital is current assets minus current liabilities on the balance sheet. A farm should aim for a healthy level of working capital. More lenders are lending on cash-flow rather than collateral in current times. Lenders are concerned about adequate working capital. The right amount of working capital will show the farm is able to pay its liabilities on time. Adequate working capital proves the business has enough cash when needed. Surplus working capital will trigger farm improvements. When countering crop peril, working capital is self-insurance in tandem with crop insurance. A shortfall between the cost of production and a crop insurance indemnity is made right by working capital.

I forecast three results of tracking working capital monthly.

- The farm will learn how grain marketing impacts working capital. This understanding will improve marketing decisions and vice versa.

- The farm will identify when working capital is in surplus. Surplus working capital will trigger farm improvements, farm expansion and/or debt reduction discussions.

- The farm will identify inadequate working capital levels and build a plan to grow it with their lender

The chart below gives a format and instructions for computing and tracking working capital.

The second year (2017), we asked Ag lenders the same question, “What is the biggest concern on farm currently?” We noticed we did not hear any mention of working capital.

I asked one lender, “What about working capital? Last year, that’s all the smart lenders could talk about.”

He replied honestly, “Working capital is gone.”

I paused, “Okay. If it’s gone, now what?”

He explained, “Farms are restructuring debt to make available working capital.”

If I understood the lender correctly, after restructuring if there is not a plan to build working capital and it goes away, then the next phone call is to the auctioneer.

If a farm finds itself with in a low working capital situation then tracking working capital may not be that fun. But, what gets measured, matters. Thomas Monson said “When performance is measured, performance improves.”

Each farm situation is unique and fact dependent. Consult a lender for guidelines on adequate working capital and current ratios. Track working capital monthly and see how it impacts your grain marketing decisions. Make visible your findings with the farm’s stakeholders often.

Perhaps you may watch your balance sheet and grain marketing improve in tandem?

If you’re interested in optimizing your farm management decisions, check out this webinar we used on farm decision making with professional poker player Annie Duke: www.harvestprofit.com/blog/webinar-replay-farming-in-bets-with-annie-duke

Cullen Wilson

Cullen is passionate about all things grain marketing. He has a genuine appreciation for the challenges farmers have marketing their crop and has worked closely with 100's of farmers in helping them develop and execute farm-specific grain marketing plans. His hometown is Plankinton, SD. He graduated from SDSU with an economics degree in 2005. After graduation, Cullen spent seven years running a small service business near Garretson, SD as a farrier. Cullen started in the grain industry with an ethanol company in 2013 as a DDG merchandiser selling DDGs for eight ethanol plants in the eastern corn belt. Cullen joined the DPAC team in April of 2015. Cullen grew up in a family involved in the Ag construction business and a west-river cow calf operation. Cullen enjoys serving the Ag community.

Related Posts

A Simple Formula for Higher Farm Profits: The 5% Rule

Small changes can lead to large increases in farm profitability. Farms should focus on making incremental improvements to yield and price while reducing overhead expenses. This ROI-focused approach is a key step in building a successful business, farm businesses included.

Read More »3 Lessons on Farm Decision-Making From a Poker Champion

In this blog post, we share with you a video on probability-based decision making from professional poker play Liv Boeree. Her thoughts are highly applicable to farm management decision making, given the uncertainty involved with farming.

Read More »12-Step Framework for Evaluating New Farms

In this blog post, we discuss a decision framework to use when analyzing farm rent opportunities. From filtering out biases that can trip you up to using farm management software to help with your analysis, we touch base on all aspects of analyzing new farms for rent.

Read More »Webinar Replay: The 5% Rule w/ Kristjan Hebert

In this blog post, we provide a replay of webinar we hosted with Kristjan Hebert on "The 5% Rule". In farming, small improvements to yield, price, and expenses can easily lead to 100%+ increases in your farm's profitability.

Read More »