There aren’t many industries where owners have to be as multi-disciplinary as in farming.

Today’s farmer is forced to wear many “hats”…..

- Agronomist

- Precision technology expert

- Equipment repair

- Accountant

- Truck driver

- Risk manager

- And on and on!

One major role that isn’t often talked about is being an Asset Allocator.

The reason I’m writing on this topic today is that I recently had a discussion with one of my good friends (and ex-colleague). He leads a private investment fund for the personal wealth of one of the country’s most successful asset allocators, Howard Marks of Oaktree Capital Management.

Mr. Marks is worth over $1.5 billion today primarily because he’s been very good at “buying when everyone is crying”. He has a great book (Amazon link) on investing that I recommend reading this winter (hopefully on a beach somewhere sipping Mai Tia’s!).

It was so good, I read it from front to back in one day a couple years ago.

Back to farming…..

Farmers are faced with countless high dollar asset allocation decisions over their farming careers. When to buy equipment, farmland, pay taxes, build working capital, pursue off-farm investments, etc. In a perfect world, we’d all follow the following advice (as mentioned above):

“When you are crying, you should be BUYING

When you are yelling, you should be SELLING”

This advice is great and I definitely subscribe to this philosophy but we only know the correct decision when it is viewed in hindsight. Hindsight is 20/20!

I think farmers should look at applying an additional "decision layer” to their asset allocation decisions.

When participating in board meetings while I worked at ShoreView Industries (a successful Minneapolis-based private equity firm), one of the most common discussions we had was around capital expenditures. These decisions were carefully planned out with the goal of optimizing the productivity of each business.

I can tell you what wasn’t discussed, “We had a great year! Lets get our taxable income down as low as possible. Buy, buy buy!”. CapEx was well planned.

I think farmers should apply the same structured thinking to their asset allocation. It obviously doesn’t make sense to pay a burdensome amount of taxes. But we need to realize that during times of increased profitability, the farm-related assets you buy are likely inflated in price.

Instead of basing CapEx decisions around profitability and tax avoidance, let’s look at them with the goal of maximizing the farm’s productivity. With that in mind, we’re working on a new tool to aid in this process.

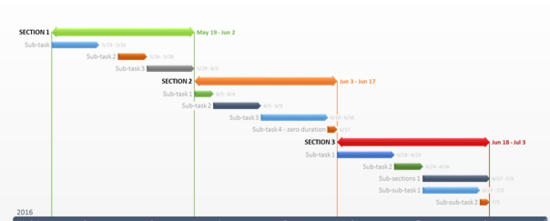

We’re going to apply structure to asset allocation decisions (specifically CapEx) by applying them to a Gantt chart. Gantt charts are typically used in project management to ensure timely completion of a project (that’s the goal anyways!).

We can use this structure to plot out the following information on your equipment.

- Hours at purchase

- Hours/year

- Targeted hours to trade/retire

- Estimated annual repair cost per piece of equipment

- Estimated amount “to boot” or net purchase price

Two valuable data points would come out of this.

- Estimated trade-in dates

- The cash flow-impact of equipment decisions (repair & acquisition)

The goal of this analysis is to allow you to conduct scenario analysis around different equipment acquisition strategies (eg. lease vs. buy, etc) and timing.

If you have a plan for when to make purchases of certain equipment, you can study the equipment market thoroughly and try to find the best deal possible.

Food for thought at this point! Any plan is better then no plan, farm equipment decisions included.

If you like content like this, sign up for our free email newsletter below.

Nick Horob

Passionate about farm finances, software, and assets that produce cash flow (oil wells/farmland/rentals). U of MN grad.

Related Posts

5 Ways for Farms to Trim Expenses in 2018

In today's volatile farm economy, farmers need to constantly be watching their bottom line. In this post, we offer 5 actionable ideas to optimize the expense side of a farm's income statement.

Read More »Which farm input cost has increased the most over the last 7 years?

In this blog post, we look which farm input expense has increased the most over the last 7 years. We also discuss how to protect our farm's bottom line from further increases.

Read More »Farming Bigger Isn't Always Better

Farming bigger isn't always better. Learn from the success of a mid-size operator with a $10 million net worth.

Read More »Liquidity is King in Farming

Working capital (and liquidity in general) are very important in a commodity business such as farming. Farmers need to constantly evaluate their balance sheets to prepare for the inevitable cyclical downturns. Liquidity is king!

Read More »