We’re dedicated to helping farmers identify their best ROI opportunities.

Today were going to look at the costs associated with drying grain. Long story short, dry grain yourself! While it’s not a secret that on-farm storage has a good ROI, I like to be able to try and quantify the benefit of on-farm drying.

- Actual corn shrink: 1.18% (see source below)

- On-farm material handling shrink: .07% (probably a little too low)

- LP dryer usage: .02 gallons of LP per bushel per percentage point of moisture removed (see source below)

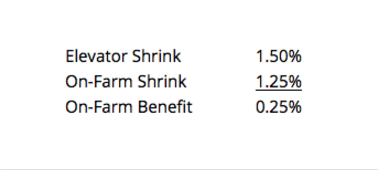

Lets first analyze on-farm vs commercial shrink. Most elevators use a shrink factor of 1.5% per point of moisture removed. In my assumptions above I’m using total on-farm shrink of 1.25%.

In the calculations below, I’m calculating the value of the cumulative shrink difference when drying 20% moisture corn down to 15%.

Now we need to calculate the value of that shrink difference at different corn prices. I’ve also included the total benefit per 150,000 bushels.

Now the fun begins, especially considering where today’s LP prices are! We need to compare the actual cost of on-farm drying vs commercial drying. Note that I’m not including the $.01-.02/bushel of maintenance electricity charges to run fans.

As you can see, if a commercial drying facility is using a drying rate of $.04/point of moisture the breakeven price of LP for your on-farm drying is $2.00 gallon. Most LP prices across the country are under $1.00 and I know of a material amount of LP bought at $.50 or less.

As an aside, when prices are at extremes throw seasonality out the window! Someone called me recently and said that their local price for a tanker load of LP was $.55. They didn’t think they were going to buy it because it was $.10 higher than their last load and that July/August is typically the best time to buy it. My answer: BUY BUY BUY. It’s 1/3 the price of where it was two years ago and eventually low prices cure low prices so who cares about the seasonality (this time).

The lesson that I’m trying to convey in this blog post is that as a great farm business manager, you need to constantly be evaluating the ROI of various activities on your farm. Assuming $1.00 LP and $3.50 corn, your annual on farm drying/shrink savings would be over $20,000 (on a farm that produces 150k bushels of corn).

Storage and on-farm drying are great farm investments. While we are definitely in trying economic times on the farm it never hurts to maintain and prioritize your capital expenditure “to-do list” if you haven’t already.

If you like this numbers-based, ROI-focused approach to farming, you should check out our farm management software. Click the button below for access to a live (and free) demo account.

Sources

Nick Horob

Passionate about farm finances, software, and assets that produce cash flow (oil wells/farmland/rentals). U of MN grad.

Related Posts

5 Ways for Farms to Trim Expenses in 2018

In today's volatile farm economy, farmers need to constantly be watching their bottom line. In this post, we offer 5 actionable ideas to optimize the expense side of a farm's income statement.

Read More »I Recently Met a Farmer in His 50's That Owns 3,000 Acres Free and Clear

In this blog post, we discuss a recent meeting we had with a farmer who owns 3,000 acres of debt-free farmland. We walk through the strategies this farmers has utilized to build a sizable net worth in a volatile farming environment.

Read More »Farming Bigger Isn't Always Better

Farming bigger isn't always better. Learn from the success of a mid-size operator with a $10 million net worth.

Read More »